For Your Will

View Proper Bequest Language

For Trustees and Financial Advisors

Ways to Give

Make a Lasting Impact

Gifts Through Your Will or Living Trust

Gifts You Can Make Now

Easy Ways to Give

Planning Tools

Planning Checklist

Peace Now Tax ID# 13-3509867

Easy Ways to Give

Gifts Made by Beneficiary Designations

These are easy gifts to set up. Simply contact

the plan administrator of your funds to obtain a beneficiary designation form. You can designate that

Americans for Peace Now receive all or a portion of any of these assets. Beneficiary designations provide

flexibility. They are revocable gifts and can be updated if your circumstances change.

These gifts pass directly to the charity outside of the probate of your estate, which means your gift can be put to

work at Americans for Peace now without waiting for the probate process to be finished.

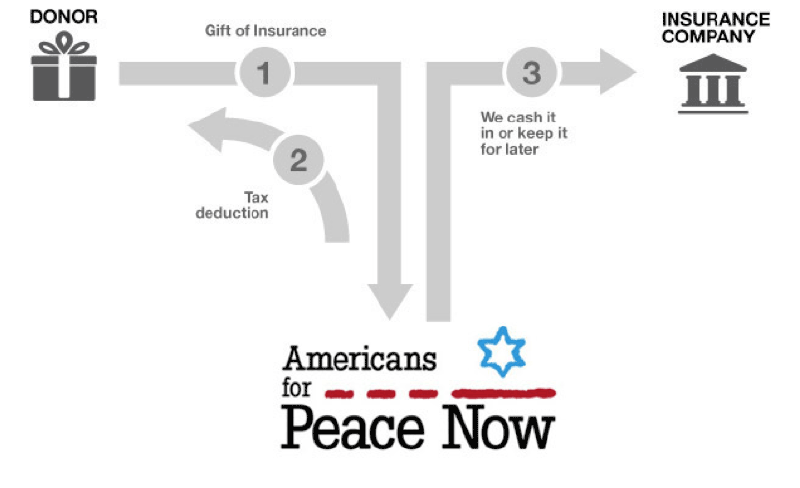

Life Insurance Policy

Consider whether your life insurance

policy is no longer needed to ensure your family’s security. If you wish to make a gift of this policy, simply

designate Americans for Peace Now as the beneficiary. You can also make Americans for Peace Now the

owner of the policy or you can also purchase a new policy and make us the beneficiary.

We have often received unexpected bequests and, as a result, never had the opportunity to thank the donors for their generosity. Your gift is truly important to us and we would like to extend our sincere thanks to you today.

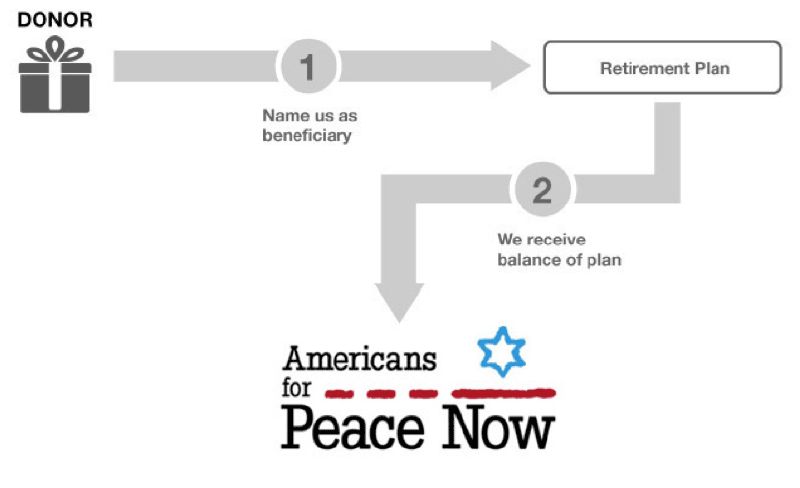

Retirement Accounts

You may give all or a portion of your

401(K), 403(b), Keogh, IRA, or other qualified pension plan to Americans for Peace Now.

Bank Accounts and Securities

You can designate that all or a

portion of specific assets be transferred to Americans for Peace Now upon your death. A POD (Payable on

Death) form is used for bank assets (e.g., savings and checking accounts, savings bonds, deposit certificates); a

TOD (Transfer on Death) form is used for securities (e.g., stocks, bonds, mutual funds). Ask your bank or

securities firm for the proper